5 Simple Techniques For The Maplewood Nursing Homes Rochester Ny

Wiki Article

An Unbiased View of The Maplewood Rochester Nursing Home

Table of ContentsThe Ultimate Guide To The Maplewood Nursing Homes In Rochester NyThe smart Trick of The Maplewood Rochester Ny Nursing Homes That Nobody is Talking AboutThe Basic Principles Of The Maplewood Nursing Home Rochester The Definitive Guide for The Maplewood Nursing Home Rochester NyThe Facts About The Maplewood Rochester Nursing Home Revealed

Long-term treatment costs differ from one location to one more. The price for long-lasting treatment services will certainly boost over time.A company needs to give you at the very least 45 days' notice of a price increase. A firm can't increase your rates due to the fact that your health and wellness becomes worse or you have claims. A business should restore your plan annually if you want it to. It can decline to restore your policy if: It learns you lied concerning your health when you got the plan.

You can cancel your policy at any type of time. If you paid six months of costs in development but terminated the policy after 2 months, the firm needs to refund 4 months of costs to you.

After you have actually had your plan for 2 years, a business can't terminate it or decline to pay insurance claims since you provided incorrect details on your application, unless the incorrect information is illegal. A firm can not terminate your policy for nonpayment of costs unless you have not paid the premium for at the very least 65 days past the due date.

Some Known Factual Statements About The Maplewood Nursing Home Rochester

If the firm terminates your plan for nonpayment, it must restore the plan if you send out evidence that you really did not pay costs due to the fact that of a psychological or physical problems. You generally have concerning 5 months to do this. The business needs to likewise pay any type of insurance claims for protected solutions. You'll need to pay premiums back to the date the policy lapsed.The 6 ADLs are showering, eating, dressing, making use of the washroom, continence, and moving from area to place - The Maplewood rochester ny nursing homes. You might also obtain benefits if you have a medical necessity or disability. Tax-qualified policies need that you have a cognitive impairment, such as Alzheimer's, or be not able to perform 2 of the six ADLs for at the very least 90 days.

Various other policies base the elimination duration on calendar days. Your removal period would finish as quickly as the variety of days passed. You can decrease your premium by selecting a longer elimination duration. Yet keep in mind that you'll need to pay of pocket for a longer time. Some policies have just one removal period.

The Best Guide To The Maplewood Nursing Homes Rochester Ny

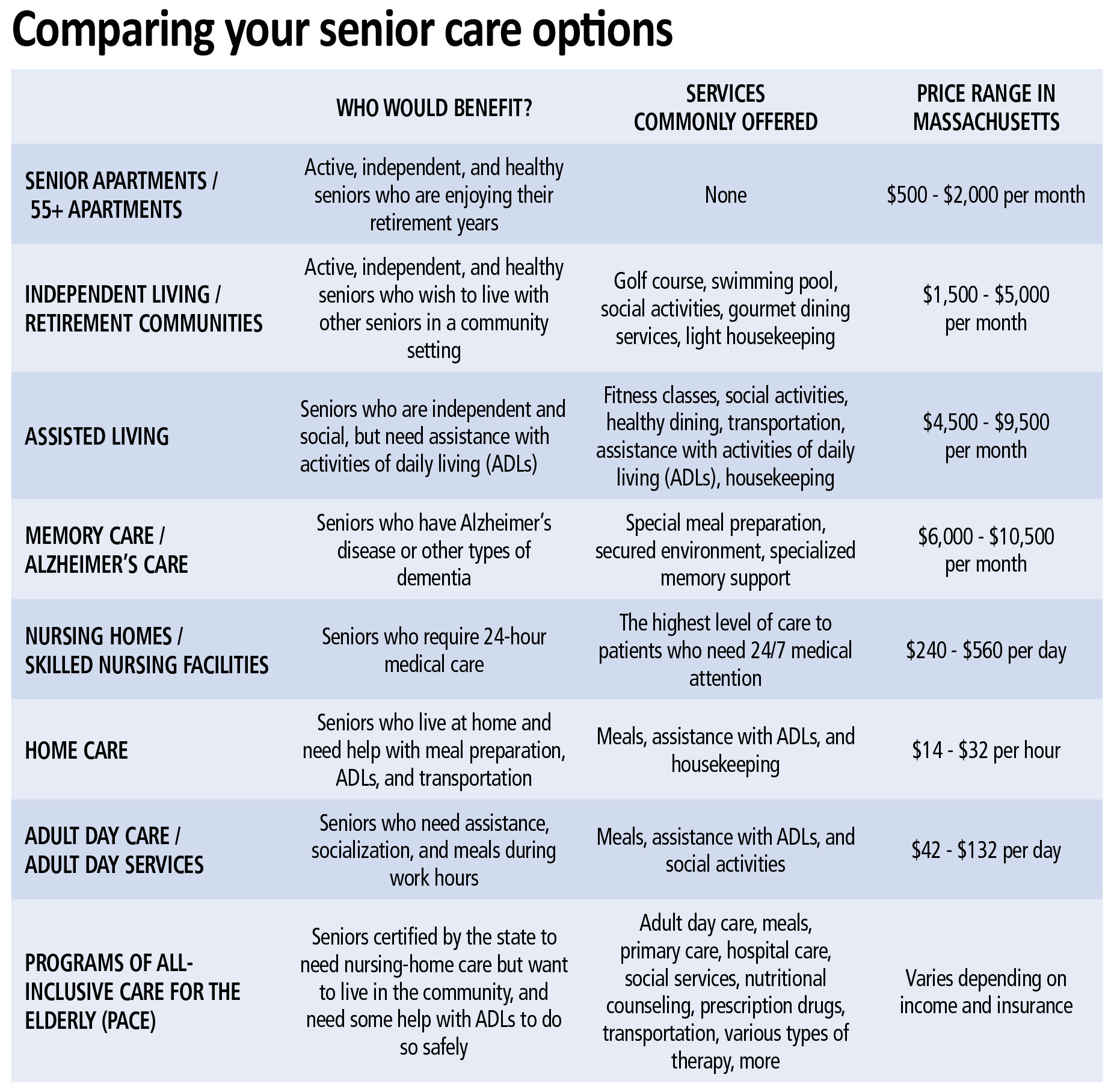

Prior to buying a policy, comprehend how the elimination period functions. An advantage period is the size of time a plan will pay benefits - The Maplewood nursing home rochester ny.If you don't use all your $100 a day benefit, your plan might last much longer than 2 years. You can generally select the benefit amounts you want. To aid you pick your benefit amounts, check costs for retirement home, aided living centers, and home wellness care firms in the area you'll live when you need treatment.

average nursing home stay

It may be years before you require long-lasting care solutions. Long-term care costs will probably go up in that time.

The company has to offer you a contrast of policy benefits with and also without inflation protection over a 20-year period. If you do not desire inflation security, you need to decline it in composing. Firms must guarantee that you'll get a few of the advantages you spent for, also if you terminate your plan or shed insurance coverage.

The Facts About The Maplewood Rochester Ny Nursing Homes Uncovered

You may be able to quit paying costs while you're in a nursing home, however not while getting adult day care solutions. The firm will certainly reimburse some or all your costs minus any kind of cases paid if you terminate your plan. Your beneficiary will get the reimbursement if you pass away.

Ask yourself these questions regarding the policies you're thinking of acquiring: Policies can supply a great deal of services, consisting of home health care, grown-up day treatment, aided living facility treatment, as well as nursing house care. They have to cover all degrees of care from custodial to intermediate to proficient care. Plans won't pay up until you've fulfilled needs, such as being unable to do tasks of everyday living or coming to be cognitively impaired.

The Main Principles Of The Maplewood Nursing Homes Rochester Ny

All business should use rising cost of living security. If you don't want it, you must reject it in creating. The firm might have various other choices for rising cost of living security. Bear in mind that to be gotten ready for rising cost of living, you have to pay a greater costs today or greater out-of-pocket expenses later. Companies have to find this supply you a warranty Discover More Here that you'll obtain several of the advantages you spent for also if you terminate or shed insurance coverage.If you buy a tax-qualified plan, you could be able to subtract part of the costs you paid as a clinical expenditure on your earnings taxes. Benefits paid from a tax-qualified plan are typically not taxed income.

Report this wiki page